Adrop in government spending dragged more on the US economy than initially thought in the first three months of the year, a sign of increasing pain from Washington's austerity drive.

Another report on Thursday showed the number of new jobless claims rose last week, and together the data reinforced the view that the US economy may be entering yet another soft patch.

Gross domestic product, a measure of the country's total economic output, expanded at a 2.4 percent annual rate during the first quarter, down a tenth of a point from an initial estimate, the Commerce Department said on Thursday. Analysts had forecast a 2.5 percent gain.

That is much faster than the prior quarter's pace, but likely still too weak to fuel faster improvements in the labor market.

"We are dramatically under-spending in Washington," said Michael Strauss, a market strategist at Commonfund in Wilton, Connecticut.

Investors took the data as a sign of weakness in the economy, and futures for US stock indexes trimmed gains while yields on US government debt fell slightly.

Growth in the first quarter was held back as government spending fell across all levels of government and as businesses outside the farm sector stocked their shelves at a slower pace.

Washington has been tightening its belt for several years but ramped up austerity measures in 2013, hiking taxes in January and slashing the federal budget in March.

Still, economic growth has been surprisingly resilient, supported by the Federal Reserve's low interest rate policies which have helped families buy homes and cars.

Thursday's data could add to the case that the economy still needs a lot of monetary stimulus, although policymakers at the central bank have been talking up the possibility of easing back on their bond buying program this year.

Most economists expect growth will slow around the middle of 2013 as budget cuts bite across the public sector. But growth is seen picking up by year end, propelled by consumer spending and an apparently entrenched housing market recovery.

Government spending has now fallen sharply in two straight quarters and economists believe agencies have pulled back in anticipation of budget cuts that were initially due to begin in January but which took effect in March.

In the first quarter, government spending dropped at a 4.9 percent annual rate, faster than the 4.1 percent rate initially estimated. Spending fell at federal, state and local government offices, though the majority of the downward revision in Thursday' report came at the state and local level.

Washington has been trimming deficits for several years as programs enacted to fight an economic crisis have wound down. This year, the federal government is on track to slash its budget shortfall by the most in nearly a half century.

In the first quarter, the drag from government and inventories was partially offset by an upward revision to consumer spending, which rose at a 3.4 percent annual rate, up two tenths of a point from the government's previous estimate.

However, a cloud hung over that category, as most of the upward revision was due to higher sales of gasoline. Higher prices at the pump are a burden on consumers, leaving them less money to spend on other things. Consumer spending accounts for more than two-thirds of U.S. economic activity.

Excluding the volatile inventories component, GDP rose at an upwardly revised 1.8 percent rate, slightly higher than analysts had forecast.

More jobless claims

A separate report showed the number of Americans filing new claims for unemployment benefits unexpectedly rose last week.

Initial claims for state unemployment benefits increased 10,000 to a seasonally adjusted 354,000, above analysts' expectations, Labor Department data showed.

A Labor Department analyst said claims for five states, including Virginia, Minnesota and Oregon, were estimated since state offices had less time to prepare data because of the national holiday on Monday.

This could have the distorted the readings, making last week's claims a less useful gauge of labor market trends.

The four-week moving average for new claims, which irons out week-to-week volatility, edged up 6,750 to 347,250.

Despite the rise last week, claims remained in the middle of their range for this year and below levels economists normally associate with modest job gains.

Steady improvement in labor market conditions and rising house prices are helping to sustain consumer spending, limiting the impact of the drag from fiscal policy on the economy

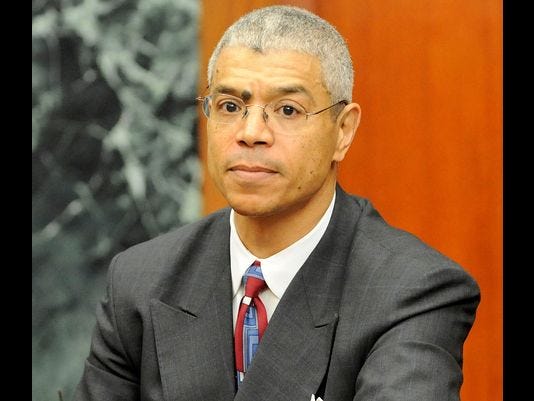

ANN ARBOR, Mich. -- For the first time since the Michigan Judicial Tenure Commission issued a complaint against Wayne County Circuit Judge Wade McCree, .

ANN ARBOR, Mich. -- For the first time since the Michigan Judicial Tenure Commission issued a complaint against Wayne County Circuit Judge Wade McCree, . 2016.

2016. MIAMI — You could sense the LeBron James power surge coming in South Florida.

MIAMI — You could sense the LeBron James power surge coming in South Florida. While hiding in a boat before his capture last month, Dzhokhar Tsarnaev, the man later charged in the Boston Marathon bombings, allegedly scrawled a message on an inside wall of the vessel in which he claimed responsibility for the attacks, a law enforcement official said Thursday.

While hiding in a boat before his capture last month, Dzhokhar Tsarnaev, the man later charged in the Boston Marathon bombings, allegedly scrawled a message on an inside wall of the vessel in which he claimed responsibility for the attacks, a law enforcement official said Thursday. People living in a glass house are throwing verbal stones at a photographer and the exhibition he shot through the windows of their upscale Manhattan apartment complex.

People living in a glass house are throwing verbal stones at a photographer and the exhibition he shot through the windows of their upscale Manhattan apartment complex. ALFRED, Maine (AP) — Just two days before a police raid, a fitness instructor was feeling good about her prostitution business. With a steady stream of clients, she was making tens of thousands of dollars tax-free while continuing to collect public assistance and using her Zumba studio as a front for prostitution.

ALFRED, Maine (AP) — Just two days before a police raid, a fitness instructor was feeling good about her prostitution business. With a steady stream of clients, she was making tens of thousands of dollars tax-free while continuing to collect public assistance and using her Zumba studio as a front for prostitution. MIAMI — These Eastern Conference finals were already marked by physical play, even before Chris "Birdman" Andersen got involved Thursday night.

MIAMI — These Eastern Conference finals were already marked by physical play, even before Chris "Birdman" Andersen got involved Thursday night.